In some cases you may have a PA-41 or PA-41-AE and also have PA-20S/PA-65 so enter PA-65 in each of these cases in the Last, Estate, Trust or Entity boxes for the specific entity. You may use PA-65 in the Last, Agency, Estate, Trust or Entity boxes for various entities such as individuals, trusts and estates. For more information, see section 7.07 of IRM 5.7.4, Use of Exempt Organizations — Form 990-EZ. In some cases you may have PA-41NRC or PA-41NRC-AE. In these cases, use PA-20S/PA-65 where applicable. In these cases, use PA-65 in the Last, Estate, Trust or Entity Boxes and enter PA-65 in the appropriate Other Information for this box. If you did not enter the entity name in the Last, Agency, Estate, Trust or Entity Boxes, but do have PA-65, enter PA-65 in the Other Information for this box. If you do not have any of these items listed as your information requirements, complete the form in accordance with the applicable section and then file your application with the appropriate agency immediately using the appropriate account. When you use the correct information you should file your application as soon as possible because it can take weeks to process Forms 990-EZ. 5.7.41.3.2 (10-01-2018) Information Required on Form 990-EZ For individuals, the information on the form is required on line 12 and on lines 10-9a through 9h. For federal government, the information is required on line 12 and line 10-9c. For foreign-owned corporations, the information is required on line 12 and on lines 12a-8(b) and 12a-9. See instructions for Form 990-EZ. Each entry (line) on the Form 990-EZ must have a specific date. The date must be at least four years after the year in which the Form 990-EZ was filed unless the information is for a prior year. In all cases, the required date is the date that the Form 990-EZ was filed. Note: Use the Comment at the end of Form 990-EZ column to submit any corrections regarding these forms.

Get the free rev 276 form

Show details

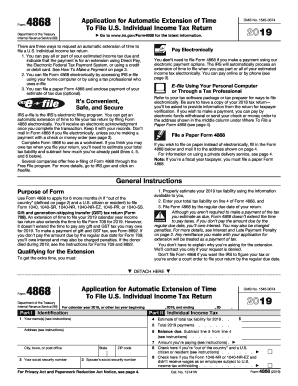

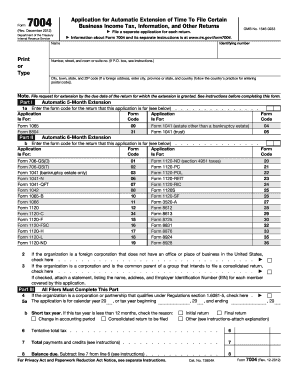

0803610054 REV-276 Application for Extension of Time to File START REV-276 EX 10 08 FI PA DEPARTMENT OF REVENUE EC OFFICIAL USE ONLY Print the first two letters of the last name if for a PA-40. If you pay by credit card or ACH debit on or before April 15 you can get an automatic four-month extension without mailing a REV-276.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your rev 276 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev 276 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rev 276 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pa form rev 276. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out pa form rev 276?

To fill out the PA Form REV-276, follow these steps:

1. Identify the tax year for which you are filing the form.

2. Provide your personal information, including your full name, social security number, and address.

3. Indicate your filing status by checking the appropriate box. The options are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

4. If you are claiming any exemptions, enter the number of exemptions you are claiming in the corresponding box. This number should reflect the number of personal exemptions you are eligible for.

5. Input any additional Pennsylvania income tax withheld from your wages or other income sources in the provided boxes.

6. If you made any estimated tax payments throughout the year, enter the total amount you paid in the estimated tax payment box.

7. Refer to your W-2 forms and other tax documents to report your taxable wages, salaries, and tips in the appropriate boxes.

8. If you are eligible for any taxable income adjustments or additions, enter the amounts in the corresponding boxes. Examples of adjustments include retirement plan contributions, health savings account deductions, and certain business expenses.

9. Report any other types of taxable income, such as interest, dividends, and rental income, in the specified boxes.

10. Calculate your total taxable income by adding up all the amounts in the various income boxes.

11. Deduct any applicable Pennsylvania personal income credits, such as the Property Tax/Rent Rebate or the Solar Energy credit, in the provided boxes.

12. Calculate your tax liability by applying the appropriate tax rate to your taxable income.

13. Finally, subtract any available tax credits from your calculated tax liability to determine your final Pennsylvania tax owed or refund due.

14. Sign and date the form at the bottom to certify the accuracy of the information provided.

Remember to keep a copy of the completed PA Form REV-276 for your records.

What is pa form rev 276?

There is no specific form with the designation "PA form rev 276" that can be identified. It is possible that the form you are referring to is specific to a particular organization or jurisdiction. To determine the exact nature and purpose of the form, it would be helpful to have more context or to consult the relevant organization or authority.

Who is required to file pa form rev 276?

The PA Form REV 276 is used for filing a Pennsylvania Department of Revenue Power of Attorney form. It is completed by individuals or businesses that want to grant power of attorney to another person or entity to act on their behalf for Pennsylvania tax purposes.

What is the purpose of pa form rev 276?

I couldn't find any specific information about a document named "PA Form Rev 276." It is possible that this is a form specific to a certain organization or jurisdiction. In general, forms with the prefix "PA" are often associated with Pennsylvania state government, but without more context, it is difficult to determine the exact purpose of this form. It is recommended to provide more information or consult with the relevant authorities or organization to understand the purpose of this particular form.

What information must be reported on pa form rev 276?

The PA Form REV-276, also known as the Pennsylvania Tax Forgiveness Application, requires the following information to be reported:

1. Personal Information: This includes your name, social security number, date of birth, and contact information.

2. Household Information: You need to provide details regarding your household, including the number of people living with you and their relationship to you.

3. Income Information: Report all sources of income for yourself and other members of your household. This includes wages, self-employment income, rental income, unemployment compensation, Social Security benefits, pensions, etc. You should attach relevant documentation like pay stubs, W-2 forms, or 1099 forms to support your reported income.

4. Deductions and Expenses: List any deductions or expenses you may qualify for, such as medical expenses, child care costs, student loan interest, etc. Attach supporting documents where necessary.

5. Assets and Liabilities: Declare any assets you own, such as property, vehicles, savings accounts, investments, etc. You must also report any outstanding debts or liabilities.

6. Tax Compliance: Indicate whether you have filed your state and federal tax returns for the relevant tax year and whether you owe any outstanding tax liabilities. Provide the requested information about your tax filing status.

7. Additional Information: You may be required to answer additional questions or provide any necessary explanations to support your application.

Remember to carefully review the instructions and guidelines provided on the form to ensure you accurately report all required information.

When is the deadline to file pa form rev 276 in 2023?

I’m sorry, but as of now, there is no specific information available regarding the deadline to file PA Form REV-276 in 2023. Deadlines for tax forms are usually announced and published by the relevant tax authorities closer to the filing season. It is recommended to refer to the official website of the Pennsylvania Department of Revenue or consult with a tax professional for the most accurate and up-to-date information regarding tax form deadlines.

What is the penalty for the late filing of pa form rev 276?

The penalty for the late filing of PA Form REV-276, also known as the Annual Withholding Reconciliation Statement, is 1% of the unpaid tax liability per month, up to a maximum of 25%. The penalty is applied to the tax liability reported on the form. Additionally, interest may also be charged on any unpaid tax liability. It is always recommended to file tax forms on time to avoid penalties.

How can I modify rev 276 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your pa form rev 276 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the form rev 276 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your pa rev 276 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit pa rev 276 online on an Android device?

With the pdfFiller Android app, you can edit, sign, and share rev 276 online form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your rev 276 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Rev 276 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.